Asset Allocation

Asset Allocation

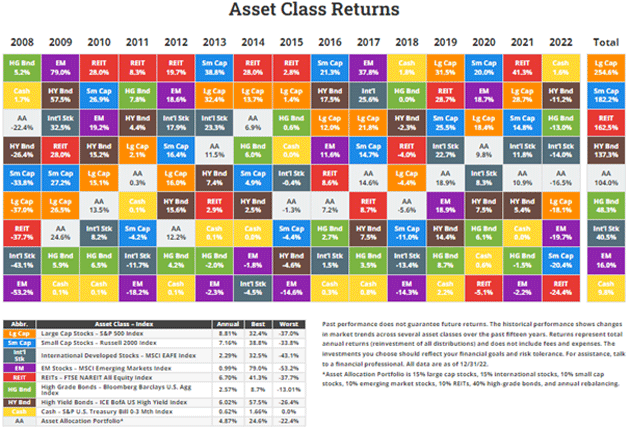

Since 2008, international stocks—both in developed countries and emerging markets—haven’t fared well compared to US equity, real estate, and fixed income. They have returned less than their counterparts, even when we include US investment grade and high-yield fixed income.

In the graphic below, you see the returns of various asset classes going back to 2008. The only thing doing worse than international stocks was cash.

Source: https://novelinvestor.com/asset-class-returns/

Source: https://novelinvestor.com/asset-class-returns/

However, in our conversation, Peter Boockvar points out certain macroeconomic variables that could turn into tailwinds for these stocks and reverse the longstanding trend. You don’t want to miss his take on the best investment opportunities for 2023.

Comments

Post a Comment