Economic Breakout

Economic Breakout

Last week, the Citigroup Economic Surprise Index (CESI) closed at the highest level in six months, with the index above zero. The breakout occurred after the index cycled from a pessimistic reading of -50.

Breadth is more volatile, but thrusts remain compelling

Whenever we look at something like breadth thrusts or evidence of overwhelming pressure either way, like last week, we get the usual poo-poos about their efficacy given high-frequency trading, zero-dated options, or a handful of other excuses.

For over 20 years, we've acknowledged that breadth statistics are fluid and influenced by various factors. The most significant factor is one that few discuss anymore - the impact of decimalization when stocks ceased trading in fractions. It became easier for security to rise or decline instead of being considered unchanged on the day.

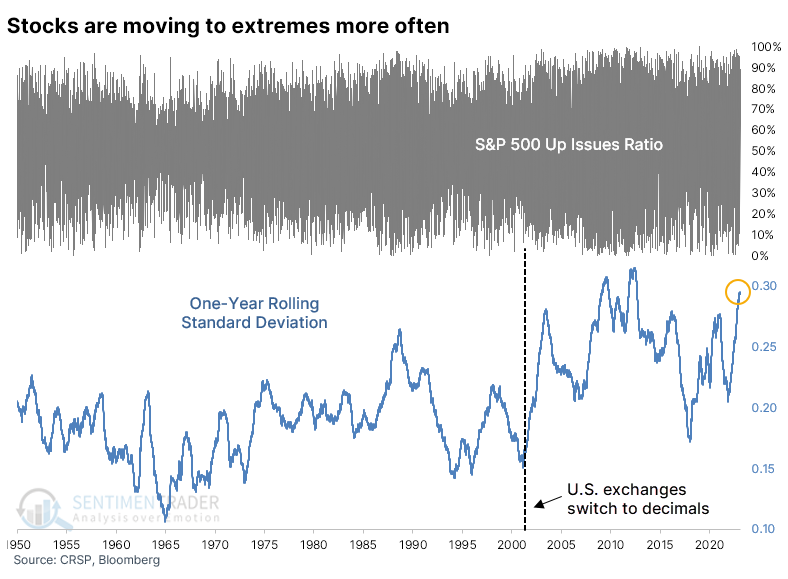

The chart below shows the daily Up Issues Ratio (Up Issues / (Up Issues + Down Issues)) for the S&P 500 since 1950, along with its rolling one-year standard deviation. The impact of decimalization seems clear, and it's really the only factor we've looked at that seems to have had a pronounced and lasting impact.

Comments

Post a Comment